Financial Planning

Our team helps you identify and prioritize your financial goals, whether it's buying a home, saving for retirement, funding your children's education, or starting a business. It provides a roadmap to help you achieve these goals by establishing clear objectives and creating a plan of action.

Life Is Not A Single Step…And Your Financial Planning Shouldn’t Be Either.

Financial and investment planning is a continual process in the relationship between our clients and the certified financial planners at Whetro Wealth Management. Our objective is to help you understand how your finances are working on your behalf. We are here to explain that process to you as often as necessary, educate, and provide guidance in regards to investment. Together, we create a future for you that reflects your short and long term goals, giving you the financial freedom to enjoy the lifestyle you’ve sought after for retirement.

Financial Planning Isn’t A Product. It’s A Process.

Financial planning is the integration of your resources with your goals. It also provides scope to the best direction for your finances. Working with our certified fiduciary experts, you learn how your money is at work on your behalf while avoiding impulsive decisions. A “hot” trend doesn’t equate to longstanding security. This is the benefit of working with Whetro Wealth Management. As an independent financial advisory firm, we aren’t focused on a singular “product” or branded investment to recommend. The relationship between Whetro Wealth Management and our client is one built on trust and transparency. Your success is important to us and this is why we work directly with you to ensure each decision reflects your financial desires. Our advisors will help explain the how and why, creating the ideal financial plan for your needs.

Whetro is Providing Toledo’s The Necessary Tools For Financial Success

No matter the goal, we are here to work with you to ensure that they’re attainable. Together, we will create a strategy that key financial elements necessary to attain these goals. Our financial experts will meet as often as necessary to review your finances and adjust to the changes life sends your way. Whetro is here to help you towards a successful financial journey.

Contact us for a free consultation today.

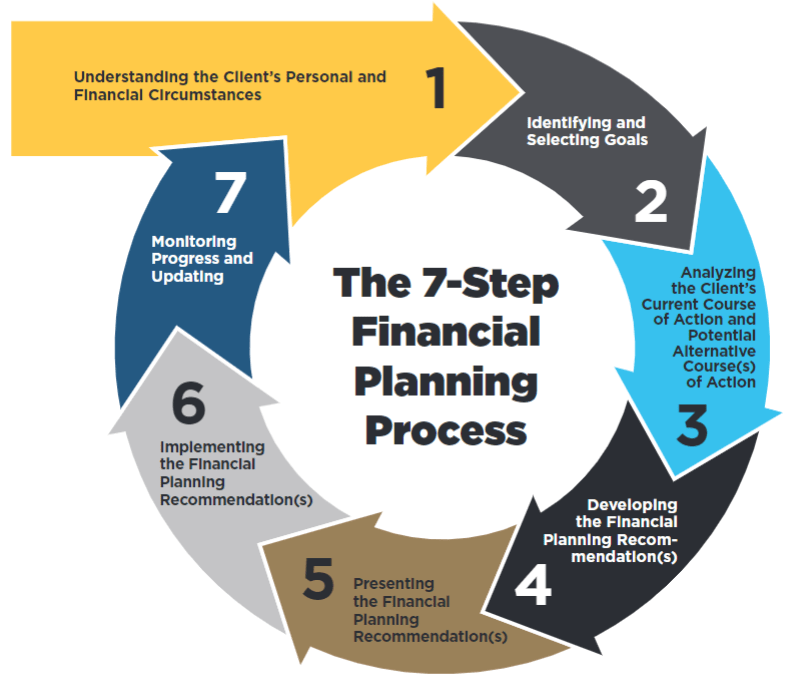

The 7 Steps To Creating A Successful Financial Plan

Once your financial goals are established, the next step is to develop a plan that keeps your goals on track. This allows you to quantify your efforts, make spending adjustments, and determine the time it will take to meet each of these goals. Budgeting, investments, retirement planning, tax preparation, estate planning, risk management…these are the building blocks upon which your plan will be built.

The timing of your financial plan is determined by your financial goals. While some plans will stretch over a designated period of time, the ultimate goal is flexibility that accounts for life changes without causing duress. Whetro works side by side with you to establish your plan to do that very thing.